The landscape of American philanthropy is approaching a massive crossroads. As we edge closer to the sunset of several key provisions within the Tax Cuts and Jobs Act (TCJA), both individual donors and nonprofit organizations are bracing for a seismic shift. Understanding the changes to charitable tax deductions 2026 is not merely a matter of accounting; it is a vital strategy for survival and growth.

The purpose of this guide is to navigate the complexities of the upcoming tax year, ensuring your organization remains compliant while empowering your supporters to give generously and strategically.

The 2026 Cliff: Why Everything is Changing

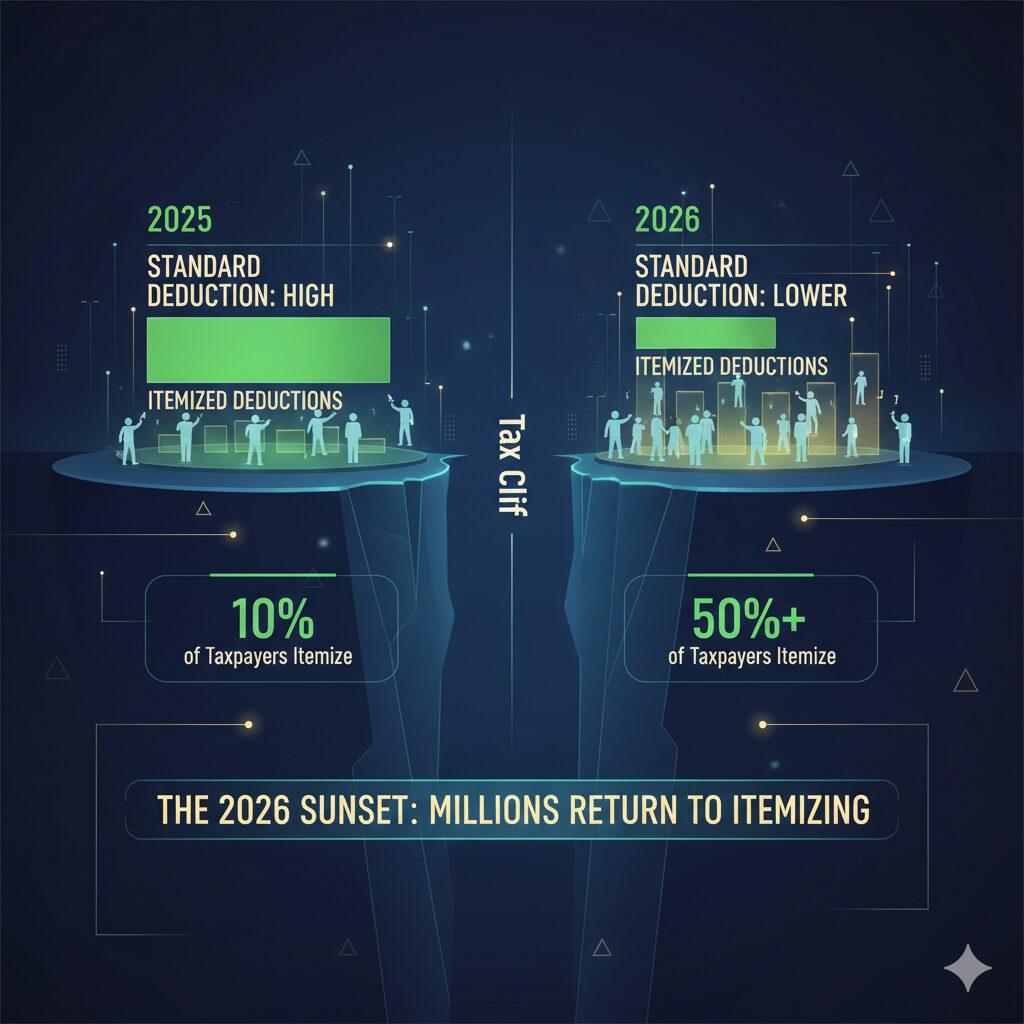

For the past several years, the standard deduction has been at historic highs, which led many taxpayers to stop itemizing. However, on December 31, 2025, many of the provisions that defined the current tax era are scheduled to expire. This “sunset” means that without new legislation from Congress, the tax code will revert to older models, significantly altering how much donors can deduct from their taxable income.

In addition to the shifting deduction floor, the tax brackets themselves are expected to adjust. This creates a cause-and-effect scenario where the “cost of giving” changes for your major donors. If their marginal tax rate increases, the value of their charitable deduction may actually become more powerful, making 2026 a year of unprecedented opportunity for fundraising.

Staying Legal: Compliance is Non-Negotiable

As regulations shift, the IRS will be looking closely at how 501(c)(3) organizations report their earnings and how they acknowledge gifts. Emphasis must be placed on the accuracy of your contemporaneous written acknowledgments.

To remain in good standing, organizations should frequently consult resources like Charity Filings to ensure their state and federal registrations are up to date. Failing to maintain legal compliance can result in the loss of your tax-exempt status, which would be catastrophic for your donors’ ability to claim deductions.

Key Compliance Areas to Monitor:

- State Registration: Ensure you are registered to solicit funds in every state where you have a significant donor base.

- IRS Form 990: Accuracy in reporting is more critical than ever as transparency becomes a primary donor demand.

- Gift Substantiation: Donors will need precise receipts to navigate the stricter itemization rules expected in 2026.

How the Sunset Impacts the Standard Deduction

The most significant change involves the standard deduction, which is expected to be nearly cut in half (adjusted for inflation). Ultimately, this means millions of taxpayers who previously took the standard deduction will find it more beneficial to itemize their deductions once again.

In contrast to the 2018–2025 period, where only about 10% of households itemized, 2026 could see a massive resurgence in itemization. This is a proven catalyst for increased giving, as the financial incentive to donate is restored for the middle-class donor base.

Informing Your Donors: The Power of Education

Donors are often unaware of how tax law changes affect their personal finances. By being the first to inform them, you position your nonprofit as a trusted authority. This builds a formidable bond between the supporter and the cause.

Strategies for Donor Communication:

- The “Bunching” Strategy: Encourage donors to “bunch” their donations. If they find themselves just below the new itemization threshold, they might give two years’ worth of donations in 2026 to maximize their tax benefit.

- Qualified Charitable Distributions (QCDs): For donors over 70½, QCDs remain a brilliant way to give directly from an IRA, bypassing taxable income regardless of whether they itemize.

- Appreciated Assets: Remind donors that giving stocks or property remains one of the most effective ways to avoid capital gains taxes while supporting a cause.

Strategic Fundraising in a Shifting Economy

The conclusion of the TCJA provisions doesn’t have to mean a dip in revenue. On the contrary, if your organization is proactive, you can capture the “urgency” of the shift. Use persuasive messaging that highlights the dual benefit of your mission and the donor’s tax health.

According to the National Council of Nonprofits, staying ahead of policy changes is one of the most important administrative tasks for any executive director. By keeping a pulse on Washington, you can pivot your marketing materials to reflect the most current laws.

Navigating the Transition: A Step-by-Step Checklist

To ensure your organization is ready for the changes to charitable tax deductions 2026, follow this roadmap:

- Audit Your Receipting Process: Ensure your system automatically generates IRS-compliant receipts that include the “no goods or services were provided” language.

- Update Your Website: Include a “Ways to Give” page that mentions the benefits of itemizing under the new 2026 rules.

- Consult Professionals: Encourage your donors to speak with their tax advisors. While you can provide information, you should never provide legal or tax advice. You can find professional guidance on compliance and filing at Charity Filings.

- Analyze Donor Data: Identify “borderline” itemizers—those who give between $2,000 and $10,000 annually. They will be the most impacted by the standard deduction change.

The Role of Transparency

In a world of shifting regulations, transparency is your most potent asset. The IRS Tax Exempt & Government Entities Division provides constant updates on filing requirements. By maintaining a transparent relationship with the public, you ensure that even when tax laws become complex, your donor’s trust remains simple and steadfast.

Ultimately, the donors who feel most secure in the legality and impact of their gift are the ones who will continue to support you through economic cycles.

Potential Challenges and How to Overcome Them

One major challenge is the potential for donor “fatigue” or confusion. When tax laws change, the natural reaction for many is to wait and see. This hesitation can lead to a “giving gap” in the first quarter of 2026.

However, you can mitigate this by launching an educational campaign in late 2025. Use emphasis on the fact that your mission hasn’t changed, even if the tax forms have. Reiterate that the purpose of their gift is the impact on the community, while the tax benefit is a welcome “thank you” from the government.

Conclusion: Turning Change into Opportunity

The changes to charitable tax deductions 2026 represent one of the most significant shifts in philanthropic history. While the technicalities of the law may seem daunting, the core mission remains the same: connecting generous hearts with meaningful causes.

By staying legal through diligent filing and informing your donors with authoritative insights, you do more than just raise money—you build a resilient community. Use resources like The NonProfit Times to stay informed on industry trends and Charity Filings to keep your administrative house in order.

The future of fundraising belongs to those who prepare today. Embrace the change, educate your supporters, and watch your organization thrive in 2026 and beyond.